Morgan Stanley’s Mike Wilson is seen as one of the best analysts in Wall Street.

He warned that the S&P 500 is ripe for another 21% crash.

If this view is valid, we could see BTC prices crash as well.

Bitcoin price dipped to about $24,000 as a somber mood engulfed the stocks and cryptocurrency industry. After rising to a high of $25,373 during the weekend, the BTC/USD price has struggled to retest it this week. And now, one of the best sell-side analysts in Wall Street, has issued a blistering warning about the market.

Morgan Stanley’s Wilson warning

In a note on Tuesday, Mike Wilson, the Chief Equity Strategist at Morgan Stanley, warned that the S&P 500 could crash by another 21%. If this happens, it means that the index could crash from the current $4,000 to about $3,140.

Wilson noted two main things that could push the S&P 500 index much lower in the near term. First, there is a reset of expectations about the Federal Reserve. The argument is that investors were expecting the Fed will start pivoting soon.

However, the reality is that recent data point to more hikes this year. Inflation remains stubbornly high while the unemployment rate has fallen to a multi-decade low of 3.4%.

Second, corporate earnings have been a bit weak. Companies like Goldman Sachs and Home Depot published relatively weak financial results. According to FactSet, S&P 500 constituent companies have had a blended growth of -4.7% in the quarter, the worst since 2020.

Further, with the bond yield being highly inverted, there is a likelihood that the US will go through a major recession. Stocks tend to underperform in such a period. Mike Wilson is not the only analyst worried about stocks. In a widely-read report, Jeremy Grantham warned that the S&P 500 could crash to about $3,200.

Implications for Bitcoin prices

Mike Wilson did not mention Bitcoin prices in his note. He did not also mention cryptocurrencies in general. However, if his warning materializes, the fact is that it will have serious implications for BTC and other cryptocurrencies.

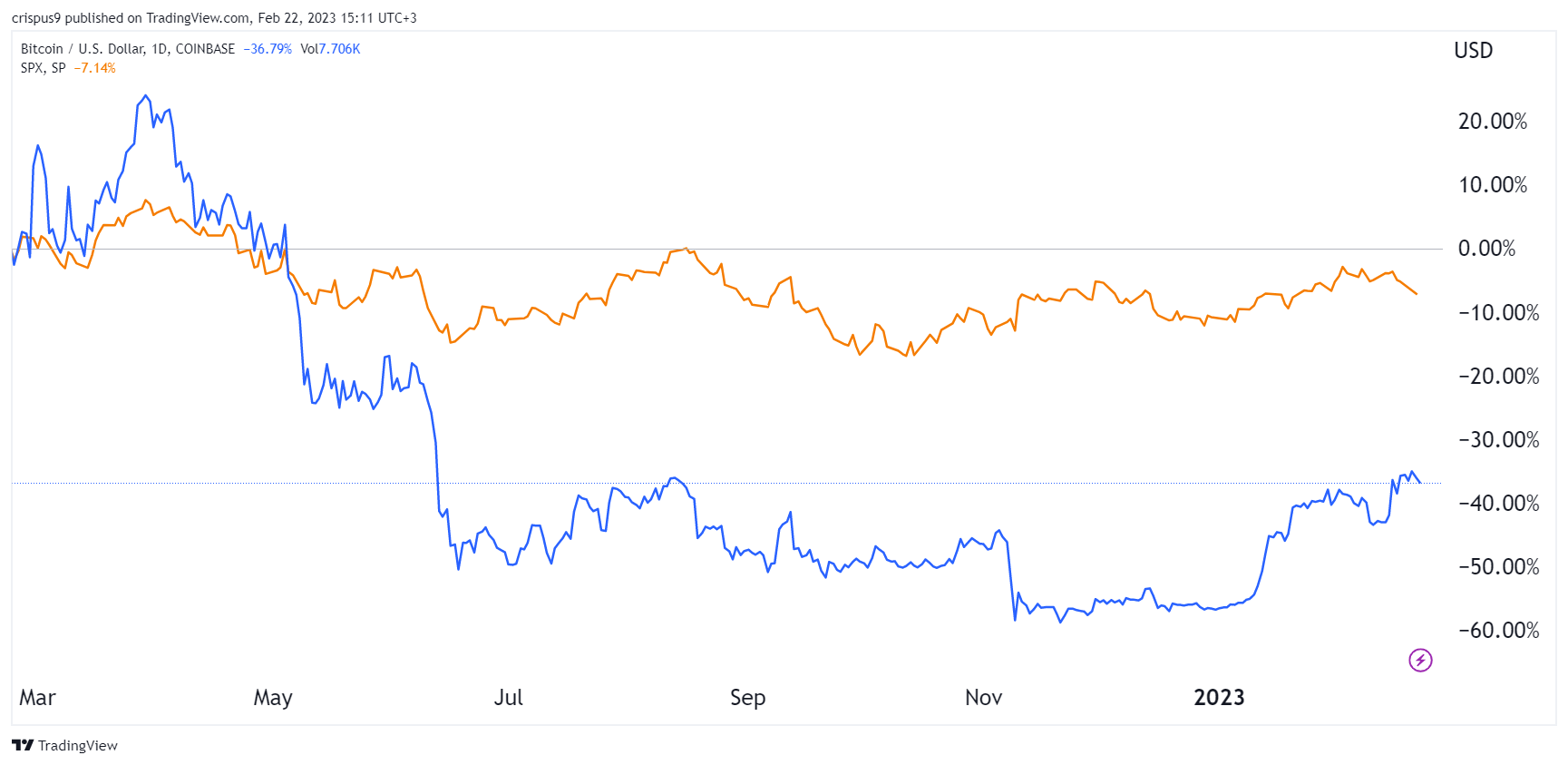

In the past few months, Bitcoin and stocks have had a close correlation. A close look at the data shows that BTC and S&P 500 have a correlation coefficient of 0.91. A correlation of 1 or close to 1 is usually a sign that the two assets are closely correlated.

Therefore, if the S&P 500 crashes by 20%, there is a high possibility that Bitcoin price will drop further than that. As such, while it is too early to predict whether Mike Wilson will be right, it makes sense to start taking profits.

The post Smartest man in the room has a warning about Bitcoin prices appeared first on CoinJournal.